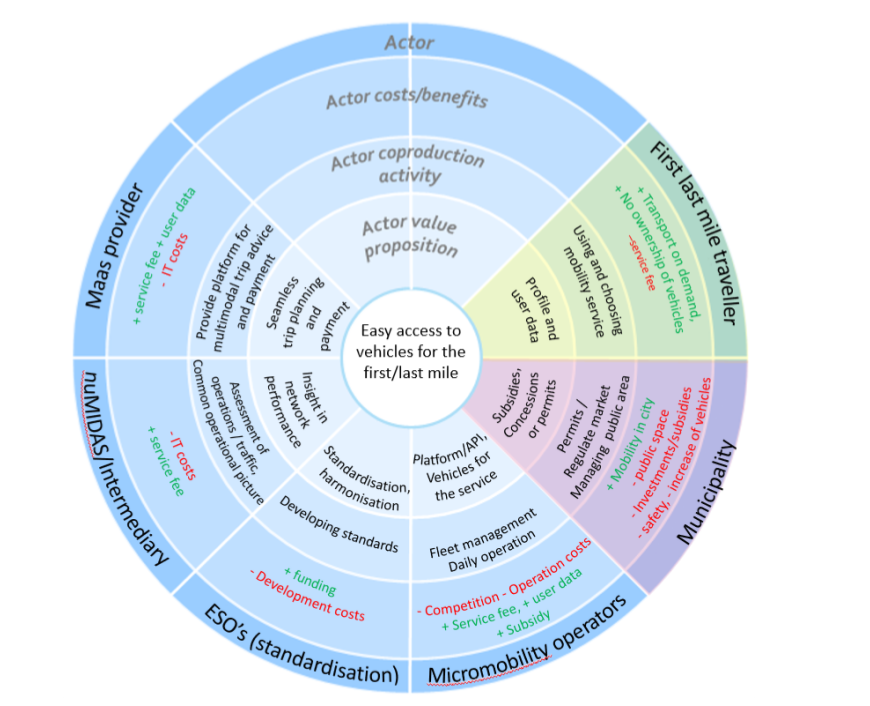

Figure 1: Business model radar for the Micromobility service

The mobility field is rapidly changing due to, among others, digitalisation, as well as the uprise of small and large electric vehicles, business models, and changing stakeholder roles. More and more services combine many disciplines, which often means that services require multiple types of stakeholders to become effective. For this reason, a stakeholder analysis was performed in the context of the nuMIDAS Deliverable 2.1, in combination with a business model analysis.

The analysis was performed using a Service Dominant Business Model Radar (SDBM/R) approach. The SDBM/R gives insight into which stakeholders can be found within the business model, as well as the way these stakeholders add value to this service. In addition to the SDBM/R, our analysis contains descriptions of the change in business models and stakeholder roles within the business models over time.

For example, the micromobility SDBM/R can be found in the figure above. Policies around micromobility vary among each city and are still changing. The micromobility service changes in response to these policies, but is also expected to change even more when MaaS providers become prevalent, as competition between micromobility providers will change.

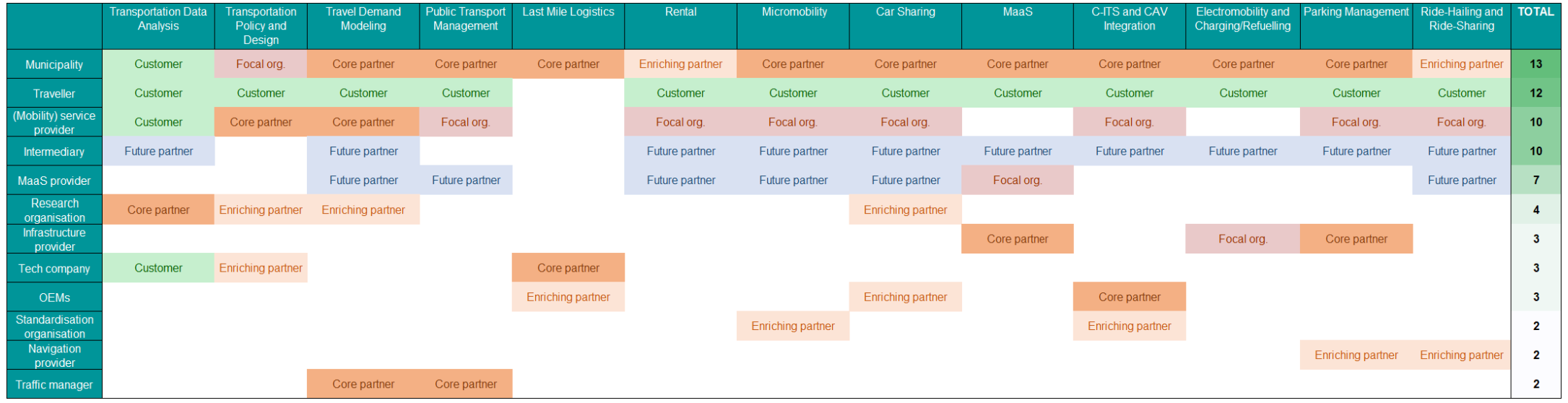

The results from the SDBM/Rs were summarised in order to get an overview of important stakeholder types. The distinguishment between the type of involvement in each service between stakeholders was consolidated into an overview which can be found in the table below

The summary resulted in a short list of the most common stakeholders within the SDBM/Rs. These are: municipalities, travellers, (mobility) service providers, intermediaries and MaaS providers. The first three stakeholders within this list are most important and most common. These three stakeholders respectively provide policies, demand and supply for transportation. The last two of these stakeholder types, intermediaries and MaaS providers, are not yet so common in the actual urban mobility field. These are categorised as future partners and are expected to become more prevalent. As transport systems become more and more integrated, while mobility service providers are competing, intermediaries stay independent and are able to handle data of competing partners with care to provide services which would otherwise not have been possible due to said competition. When the apps of MaaS providers finally really take-off, many services are expected to change, as mobility will be even more accessible from within our pockets.